Search

Marco, a young professional in Milan, used to joke that his credit cards were his “second wallet.” What started as small swipes — a dinner here, a new pair of shoes there — grew into a storm he couldn’t escape. By 29, he owed over €18,000 across four cards and a personal loan.

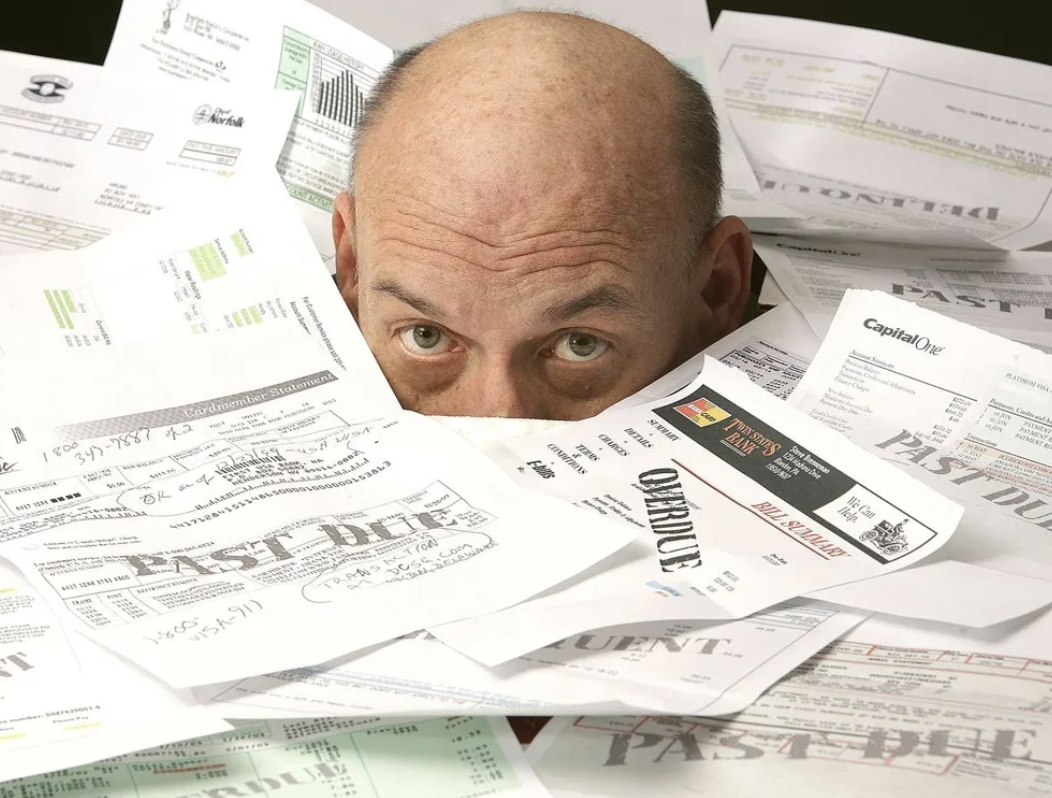

The letters from banks piled up. The late-night anxiety became constant. Worst of all, Marco stopped answering calls, afraid it was another debt collector.

It was his younger sister’s birthday when reality crashed down. He wanted to buy her a thoughtful gift, but every card was maxed out. His checking account balance: €47.

Ashamed, he skipped the family celebration. That night, lying awake, he thought: “I’m trapped. I can’t live like this anymore.”

While searching online, Marco found Sanodea Digital’s Debt Reset Pack. It promised simple, step-by-step methods to organise debt, negotiate repayment, and regain control. Desperate, he downloaded it.

The first step shocked him: write it all down. Every card, every loan, every interest rate. He realised he wasn’t €18,000 in debt — he was actually €21,450 once he included overdue fees and hidden charges. The clarity was painful but empowering.

Next, he discovered the avalanche method in Sanodea Digital’s guides:

It was slow at first. He cut back on weekends out, sold unused gadgets, and even freelanced online for extra income. Every spare euro went to debt.

Six months in, Marco paid off his first card. The feeling was indescribable — a weight lifted. He marked the date in bold red on his calendar: “Debt-Free Card #1 — Never Again.”

His confidence grew. He started calling banks to negotiate lower rates — using exact scripts he had practised from Sanodea Digital’s resources. To his surprise, some agreed. Suddenly, the mountain looked climbable.

Marco’s €21,450 debt was gone. He celebrated not with a shopping spree, but by opening a savings account — something he had never thought possible.

His friends noticed a change: he walked taller, laughed more, and wasn’t hiding anymore.

Debt doesn’t vanish overnight. But with the right tools, mindset, and a clear system, even the deepest financial hole has a ladder out.

Marco’s story is proof that no one is truly trapped. With persistence and digital support, anyone can climb free.

👉 Categories: Debt Management, Family Finance, Financial Mindset & Psychology

👉 Products linked: Sanodea Digital debt reset pack, repayment trackers, mindset coaching tools.

Leave a comment